Short Term Loans Australia Bad Credit: A Guide

Short term loans for those with bad credit can be a lifeline in Australia, offering quick access to funds when unexpected expenses arise. Understanding the nuances of these loans is crucial to making informed financial decisions. This guide explores the intricacies of short term loans in Australia for individuals with bad credit, providing the knowledge you need to navigate this financial landscape.

Understanding Short Term Loans for Bad Credit

Short term loans are designed to provide a quick injection of cash to cover immediate expenses, typically repaid within a few weeks or months. For those with bad credit, traditional lending options might be inaccessible. This is where short term loans come into play. They offer a viable solution, although they often come with higher interest rates due to the increased risk for the lender. Understanding the pros and cons is vital for responsible borrowing.

What are the Benefits of Short Term Loans?

- Speed: Applications are processed quickly, often within 24 hours. This makes them ideal for emergencies.

- Accessibility: Lenders are more lenient with credit history, making them accessible for individuals with bad credit.

- Smaller Amounts: These loans are generally for smaller amounts, making them manageable to repay.

- Online Application: The application process is usually entirely online, making it convenient and accessible.

What are the Risks of Short Term Loans?

- High Interest Rates: Due to the higher risk, interest rates are typically higher than traditional loans.

- Fees and Charges: Pay close attention to any associated fees, such as establishment fees or late payment penalties.

- Debt Cycle: If not managed carefully, short term loans can lead to a cycle of debt. Borrow only what you can realistically repay.

- Impact on Credit Score: While obtaining the loan might not significantly impact your score, failing to repay it on time can further damage your credit rating.

Finding the Right Short Term Loan in Australia

Navigating the world of short term loans can seem daunting. Here are some key considerations:

Compare Lenders:

- Interest Rates: Compare interest rates and APR (Annual Percentage Rate) from multiple lenders.

- Fees: Look for hidden fees and charges.

- Repayment Terms: Understand the repayment schedule and ensure it aligns with your budget.

- Reviews and Reputation: Research the lender’s reputation and read customer reviews before committing.

Eligibility Criteria:

- Age: Generally, you must be 18 years or older.

- Residency: Proof of Australian residency is required.

- Income: Lenders will typically require proof of regular income.

- Bank Account: You’ll need an active Australian bank account.

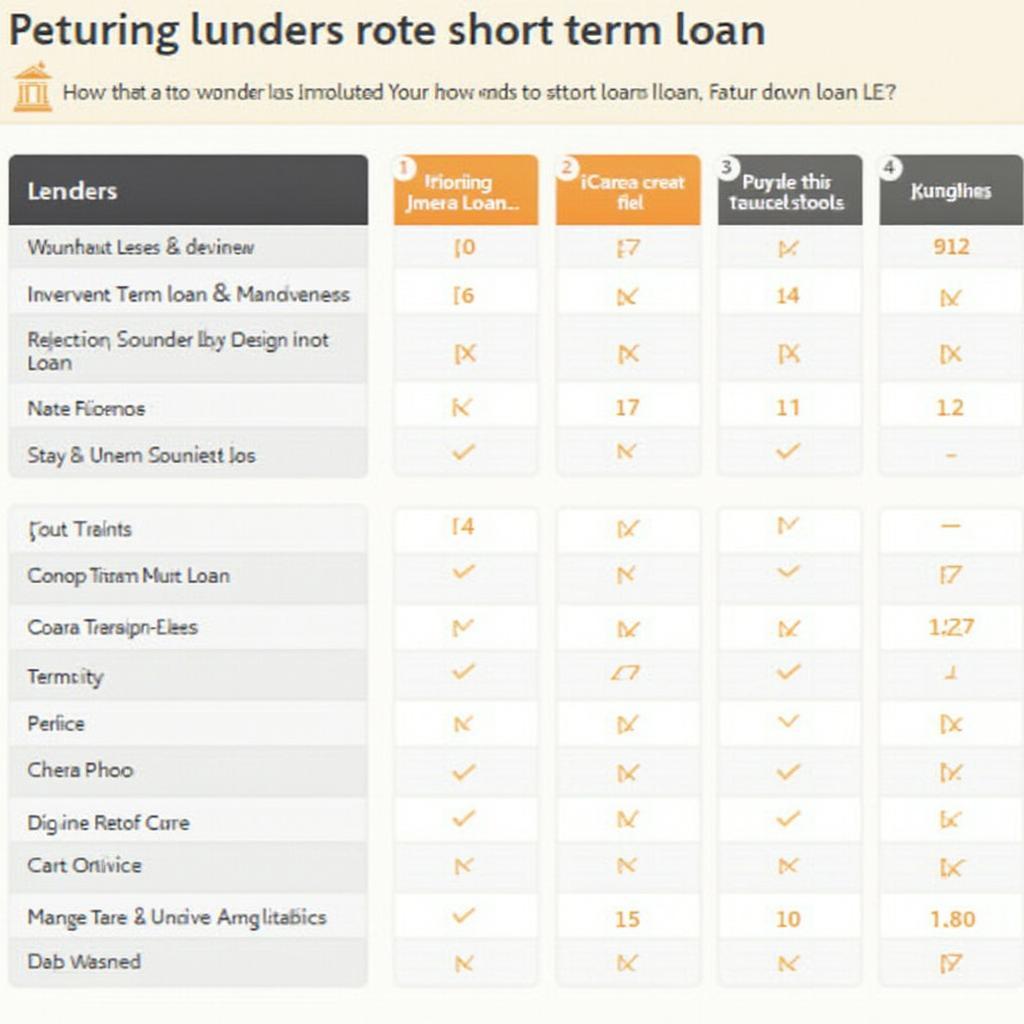

Comparing Short Term Loan Lenders

Comparing Short Term Loan Lenders

Managing Your Short Term Loan Effectively

Once you’ve secured a short term loan, managing it effectively is paramount to avoid falling into a debt trap.

Create a Budget:

- Track Expenses: Monitor your spending to ensure you can meet your repayment obligations.

- Prioritize Repayments: Make your loan repayments a priority in your budget.

- Avoid Further Borrowing: Resist the temptation to take out additional loans while repaying your current one.

Communicate with Your Lender:

- Seek Assistance: If you anticipate difficulty making a payment, contact your lender immediately. They may be able to offer flexible repayment options.

“Understanding the terms and conditions of your loan is crucial for successful financial management,” says Amelia Nguyen, a senior financial advisor at FinWise Solutions. “Don’t hesitate to seek professional advice if needed.”

Conclusion

Short term loans in Australia can offer a valuable solution for individuals with bad credit facing unexpected financial challenges. However, it’s crucial to borrow responsibly, comparing lenders, understanding the terms and conditions, and managing your loan effectively. By following the guidance in this article, you can navigate the complexities of short term loans and make informed financial decisions. Remember to always consider your personal circumstances and borrow only what you can comfortably repay.

FAQ

- What is the maximum amount I can borrow for a short term loan? The maximum loan amount varies between lenders, but typically ranges from a few hundred to a few thousand dollars.

- How long does it take to receive funds? Funds can often be deposited into your account within 24 hours of approval.

- Can I apply for a short term loan online? Yes, most lenders offer online application processes, making it convenient and accessible.

- Will applying for a short term loan affect my credit score? While the initial inquiry may have a minor impact, repaying on time can actually improve your credit score over time.

- What happens if I miss a payment? Contact your lender immediately. They may offer alternative arrangements to avoid further damage to your credit score.

- Are there alternatives to short term loans? Consider options like personal loans, credit cards, or borrowing from family and friends. “Exploring all available options helps you make the best choice for your financial situation,” adds Ms. Nguyen.

- Where can I find reputable short term lenders in Australia? Compare lenders online and check reviews from reputable sources.