Online Loans Quick Approval Bad Credit: A Comprehensive Guide

Online loans with quick approval, even with bad credit, can seem like a lifeline during financial emergencies. They offer a fast and convenient way to access funds when traditional lending options are unavailable. Understanding the intricacies of these loans is crucial for making informed decisions and avoiding potential pitfalls.

What are Online Loans with Quick Approval and Bad Credit?

Online loans with quick approval and bad credit are designed for individuals with less-than-perfect credit scores who need funds quickly. These loans are typically unsecured, meaning they don’t require collateral, and the application process is entirely online, making them accessible and convenient. Lenders offering these loans focus more on your current income and ability to repay rather than solely on your credit history.

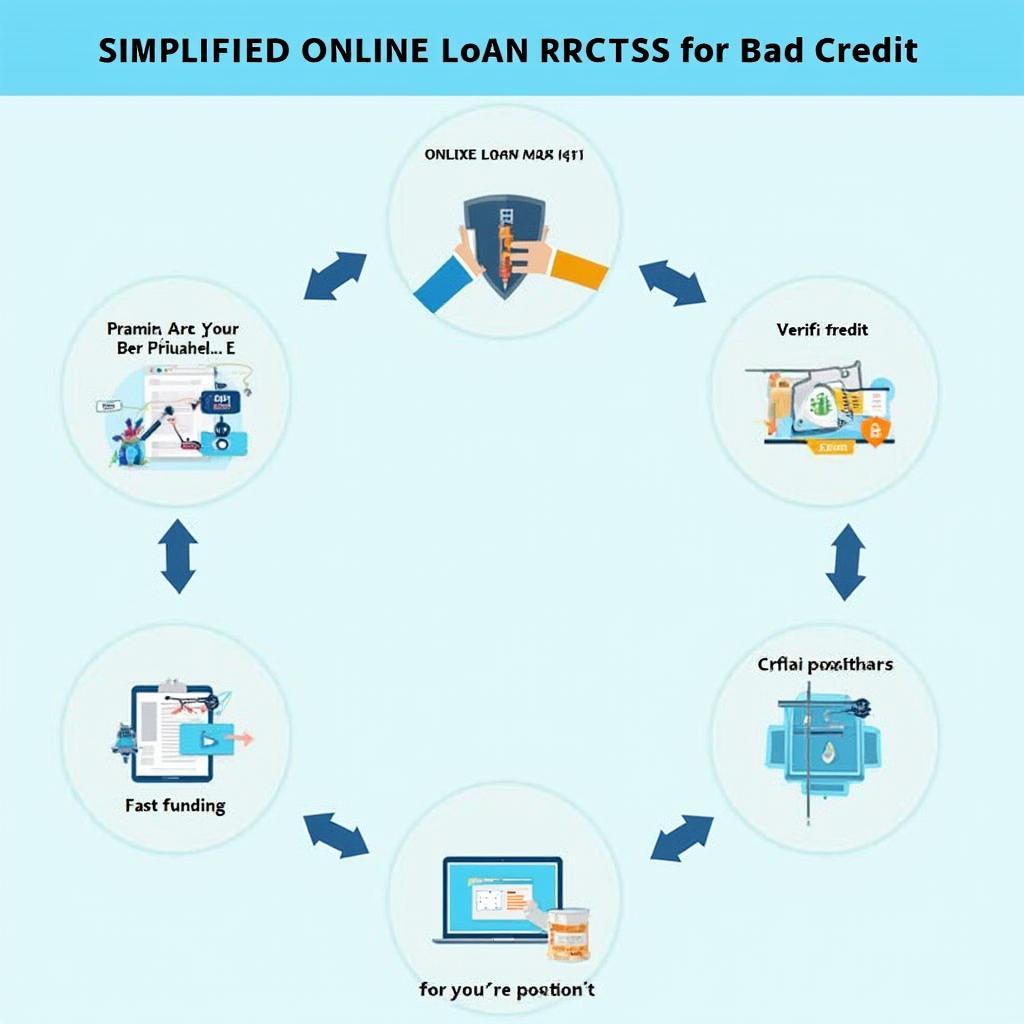

Bad Credit Loan Approval Process

Bad Credit Loan Approval Process

How Do Online Loans with Quick Approval for Bad Credit Work?

The process is straightforward. You complete an online application, providing personal and financial information. The lender then uses automated systems to assess your application and make a decision, often within minutes. If approved, the funds are deposited directly into your bank account, sometimes as soon as the next business day. This speed and convenience make these loans attractive for covering unexpected expenses. However, it’s important to understand the terms and conditions, including interest rates and fees. Remember to compare offers from multiple lenders before committing.

Benefits of Online Loans with Quick Approval Bad Credit

- Speed: Funds are often available within 24 hours of approval. This can be critical in emergencies.

- Accessibility: Applying is easy, even with a bad credit history. Traditional banks may reject applicants with poor credit.

- Convenience: The entire process is online, eliminating the need to visit a physical location.

- Flexibility: These loans can be used for various purposes, from medical bills to car repairs.

Risks of Online Loans with Quick Approval Bad Credit

- High Interest Rates: Due to the higher risk involved, these loans often carry higher interest rates than traditional loans.

- Fees: Be aware of potential fees, including origination fees, late payment fees, and prepayment penalties.

- Debt Cycle: Borrowing without a clear repayment plan can lead to a cycle of debt.

- Predatory Lenders: Be cautious of lenders who promise guaranteed approval or use aggressive tactics. Thoroughly research any lender before applying.

What to Consider Before Applying for an Online Loan with Quick Approval and Bad Credit

- Interest Rates and Fees: Compare offers from multiple lenders to find the most competitive rates and lowest fees.

- Repayment Terms: Ensure you understand the repayment schedule and can comfortably afford the payments.

- Lender Reputation: Research the lender’s reputation and read reviews from other borrowers.

- Your Budget: Carefully evaluate your budget and determine if you can afford the loan payments without jeopardizing your financial stability. “Carefully assess your financial situation before taking on any new debt,” advises Anh Nguyen, a senior financial advisor at VietFinance Group. “Make sure you understand the terms and conditions fully.”

Are Online Loans with Quick Approval Bad Credit Right for You?

Online loans with quick approval and bad credit can be a valuable tool in a financial pinch. However, it’s crucial to borrow responsibly and understand the potential risks. These loans are best suited for short-term needs and should not be used as a long-term financial solution. “Think of these loans as a short-term bridge, not a long-term solution,” says Lan Pham, financial analyst at Hanoi Investment Consulting. “Use them wisely and prioritize repayment to avoid falling into a debt trap.” If you’re unsure whether these loans are right for you, consider consulting with a financial advisor.

Conclusion

Online loans with quick approval and bad credit offer a fast and convenient way to access funds, even with a less-than-perfect credit history. However, borrowers should proceed with caution, carefully considering the risks and benefits before applying. By understanding the terms and conditions and borrowing responsibly, you can utilize these loans effectively without jeopardizing your financial well-being. Remember to compare lenders, read reviews, and create a realistic repayment plan before committing to an online loan with quick approval bad credit.

FAQ

- What is the fastest way to get an online loan with bad credit? Applying online through direct lenders typically offers the fastest approval and funding times.

- Can I get an online loan with no credit check? While some lenders advertise “no credit check” loans, most will still perform a soft credit check.

- How much can I borrow with an online loan and bad credit? Loan amounts vary depending on the lender and your financial situation.

- What happens if I can’t repay my online loan? Contact your lender immediately to discuss options. Defaulting on a loan can have serious consequences for your credit score.

- Are online loans with quick approval safe? Choose reputable lenders and be cautious of scams or predatory lending practices. Research thoroughly before applying.

- What are the alternatives to online loans with quick approval and bad credit? Consider secured loans, borrowing from family or friends, or using a credit card with a lower interest rate.

- How can I improve my credit score? Paying bills on time, reducing debt, and monitoring your credit report are key steps to improving your credit score.