How to Get Out of a Title Loan

Title loans can seem like a quick solution to a financial emergency, but their high interest rates and short repayment terms can quickly trap borrowers in a cycle of debt. If you’re struggling with a title loan and wondering how to get out, you’re not alone. This guide offers practical strategies to help you navigate this challenging situation.

Understanding Your Title Loan Agreement

The first step to escaping a title loan is to thoroughly understand the terms and conditions of your agreement. This includes the interest rate, fees, repayment schedule, and the consequences of default. Knowing exactly what you owe and when it’s due is crucial for creating a realistic repayment plan.

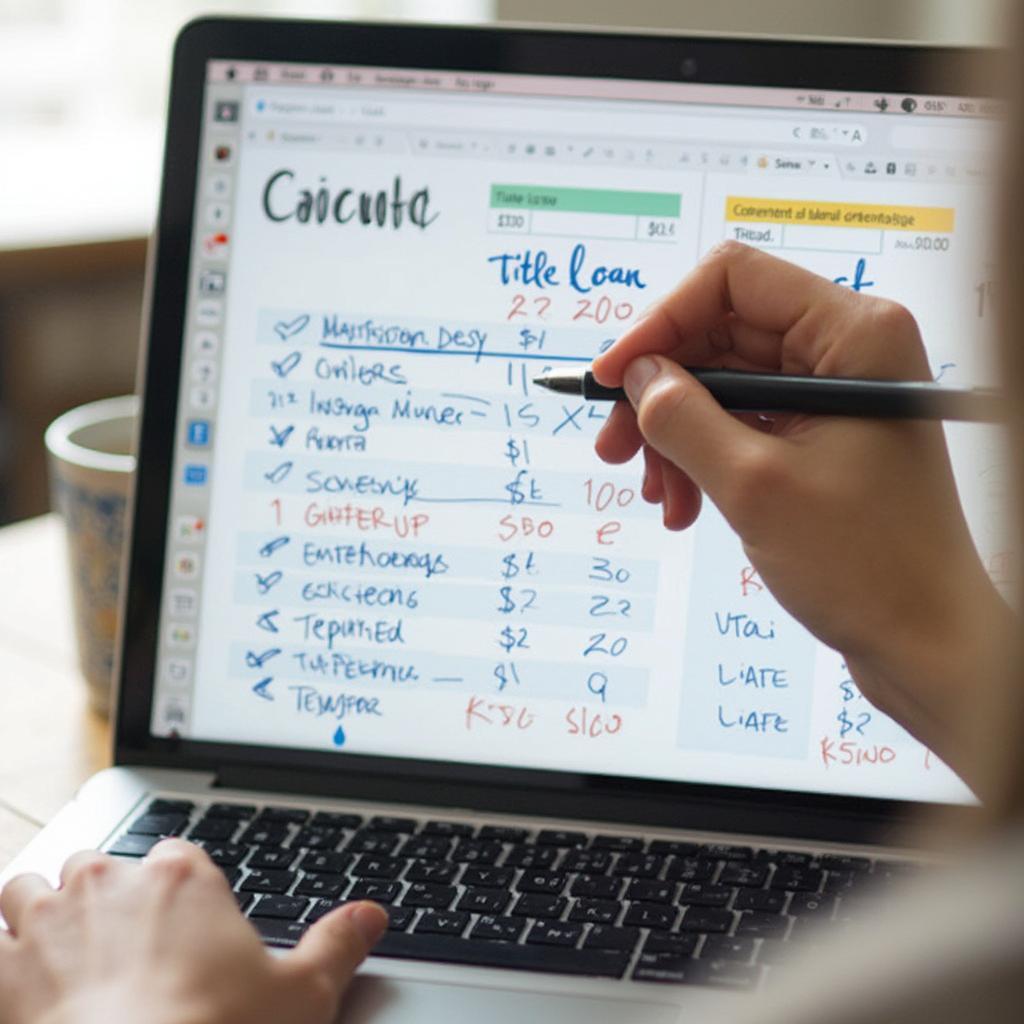

Creating a Budget and Cutting Expenses

Getting out of a title loan requires financial discipline. Develop a detailed budget that tracks your income and expenses. Identify areas where you can cut back on spending, even temporarily, to free up more money for loan repayment. Every extra dollar you can put towards your loan will help you pay it off faster and reduce the total interest you’ll pay.

Escaping Title Loan Budget

Escaping Title Loan Budget

Exploring Refinance Options

Refinancing your title loan with a lower interest rate can significantly reduce your monthly payments and make the loan more manageable. Consider contacting other lenders, including credit unions or banks, to see if you qualify for a more favorable loan. Be sure to compare the terms and fees of different refinancing options before making a decision. Similar to how to get a title loan without the car, refinancing may require certain qualifications.

Negotiating with Your Lender

Don’t be afraid to communicate with your lender. Explain your situation and see if they are willing to work with you. They may be open to extending your repayment period, reducing your interest rate, or waiving some fees. Negotiating a more manageable repayment plan can prevent you from defaulting on the loan and losing your vehicle.

Negotiating with Title Loan Lender

Negotiating with Title Loan Lender

Seeking Professional Financial Advice

If you’re feeling overwhelmed, consider seeking guidance from a certified financial counselor. They can help you develop a personalized debt management plan and provide valuable insights into managing your finances effectively. A financial counselor can offer objective advice and help you explore all available options, including debt consolidation or credit counseling.

Selling Your Vehicle

While this might be a difficult decision, selling your vehicle and using the proceeds to pay off the title loan can be a viable option. If the value of your vehicle exceeds the loan amount, you’ll have some money left over to purchase a less expensive car or explore alternative transportation options.

Consolidating Your Debt

Debt consolidation involves taking out a new loan to pay off multiple existing debts, including your title loan. This can simplify your finances and potentially lower your overall interest rate. However, be cautious when choosing a debt consolidation loan and make sure the terms are favorable. You might also consider can i get a title loan without a job if your current employment situation is unstable.

Debt Consolidation for Title Loan

Debt Consolidation for Title Loan

Expert Insight: “Title loans can quickly spiral out of control due to their high interest rates. It’s crucial to explore all available options, including refinancing or negotiating with the lender, to avoid defaulting and losing your vehicle,” says Ms. Linh Nguyen, Certified Financial Planner at VietFinance Group.

Prioritizing Title Loan Repayment

Make paying off your title loan a top priority. Even small extra payments can make a significant difference in the long run. Consider taking on a side hustle or selling unused items to generate additional income that you can dedicate to loan repayment. Remember, the sooner you pay off the loan, the less interest you’ll accrue.

Expert Insight: “Creating a realistic budget and identifying areas to cut expenses is essential for managing debt effectively. Every little bit helps, and even small changes can make a big impact over time,” advises Mr. Tuan Pham, Senior Financial Analyst at Saigon Investment Partners.

Conclusion

Getting out of a title loan requires a proactive approach and a commitment to improving your financial situation. By understanding your loan agreement, creating a budget, exploring alternative options, and seeking professional advice when needed, you can take control of your finances and regain your financial freedom. Remember that understanding how to get out of a title loan is crucial for regaining control of your finances. You might also want to explore can i get a title loan without proof of insurance or can i get a title loan without proof of income if these are relevant to your situation.

FAQ

-

What is a title loan?

A title loan is a short-term loan secured by your vehicle’s title. -

What are the risks of title loans?

High interest rates and the risk of losing your vehicle if you default. -

Can I refinance a title loan?

Yes, you can explore refinancing options with other lenders. -

What happens if I default on a title loan?

The lender can repossess your vehicle. -

Where can I get financial advice?

Consult a certified financial counselor or advisor. -

Can I negotiate with my lender?

Yes, you can try to negotiate a more manageable repayment plan. -

What are some alternatives to title loans?

Personal loans, credit union loans, or borrowing from family or friends.